When going through the open enrollment season for health insurance plans, you will likely see many options presented to you–HDHP, HMO, or PPO. It can be confusing or overwhelming. We’re going to demystify the High Deductible Health Plan (HDHP) and help you understand if it’s the right type of health coverage for you.

What exactly is a High Deductible Health Plan (HDHP)?

An HDHP is a type of health coverage that has a higher deductible and a lower monthly premium. This means that you end up paying for more of the health costs yourself before insurance starts to pay.

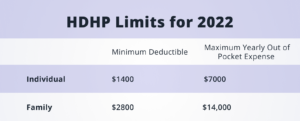

Every year, the IRS sets a minimum deductible and a maximum yearly out-of-pocket expense that individuals or families can pay. In 2022, the HDHP limits are:

Related Content

How Does a Health Savings Account (HSA) Fit In with an HDHP?

HDHPs are generally paired with an HSA to help pay for the cost of medical expenses. Employers can offer the extra incentive of contributing money to your HSA once you open an account. There are numerous tax advantages to having this type of medical savings account. Additionally, an HSA offers opportunities to invest money that isn’t being used for medical expenses and can be used for retirement.

How Do I Know if an HDHP/HSA is the Right Option for Me?

When looking at the HDHP/HSA option, it is essential to consider your medical expenses and run the numbers in advance. If you or your family are healthy and rarely go to the doctor or only use your health insurance for preventative care, then an HDHP/HSA could be the right choice for you. However, if you have higher medical expenses or a chronic condition that requires you to be at the doctor more often, you may want to consider a different type of medical plan. Some questions to ask yourself: How much do I usually spend on medical expenses in a year?

• How often do I see the doctor in a year?

• Do I have a chronic condition that requires me to see a doctor often?

• Do I foresee large medical expenses (i.e., pregnancy, planned surgery) coming up?

• How much do I usually spend on medical expenses in a year?

Whether or not an HDHP/HSA is the right option for you, understanding your medical expenses will not only help you today but also in the future.