Tax season is upon us, and while this is not a pleasant thought for many (if not most people), one positive is the tax savings you receive with your health savings account (HSA). Whether this is your first year with an HSA or you need a little refresher, we have compiled a guide to help you during tax time:

HSA Tax Advantages & Contribution Limits

First, a quick refresher on the four unique tax advantages of an HSA – (1) contributions into the account are tax-free, (2) money can grow in your account tax-free, (3) money can be withdrawn tax-free for qualifying medical expenses, and (4) no FICA or payroll tax on contributions through payroll deferral.

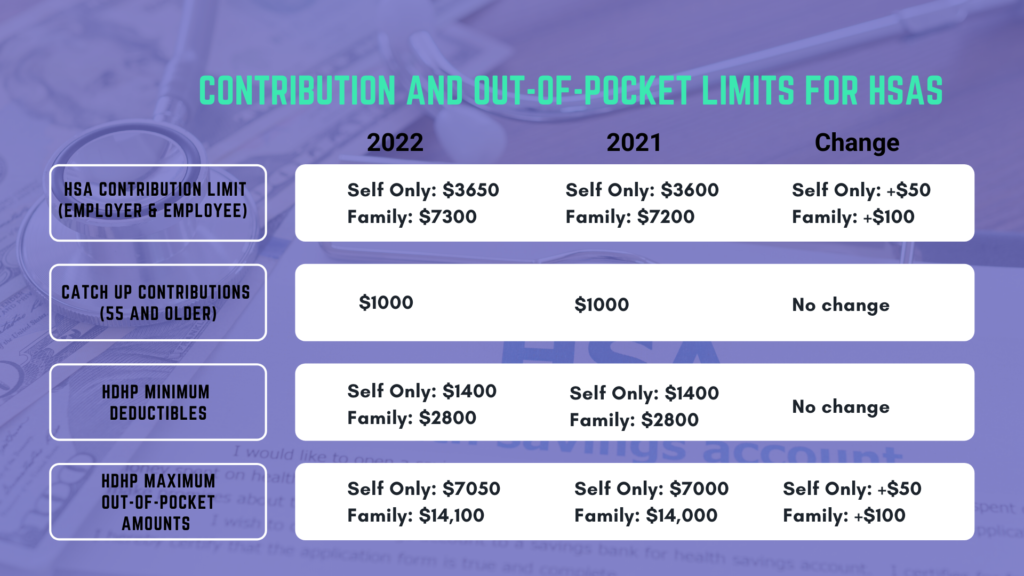

Here’s a quick reminder of the contribution limits for 2022. Remember that the contribution deadline is the same until the tax deadline for the year. This year it’s April 18th, 2022.

Tax Forms for Distributions and Contributions

There are essentially two tax forms you will need during tax time:

1099-SA: When filing your tax return, there are a few things to remember. You must report if you made a withdrawal (or a distribution) during the year. The withdrawal (or distribution) can be for a qualified medical expense or other reason. The form you need is a 1099-SA, which shows all your distributions from your HSA in the year. This form arrives in February and can be mailed or filed electronically.

IRS 5498-SA: This form shows the amount of money you contributed to your account during the year and the fair market value of your HSA. Generally, this form shows up around May–to give you time to make contributions until the final date on tax day. Keep this form for your records. If the amount you reported differs from the amount shown on the form – contact your HSA provider.

Note: SavingOak does not provide tax advice. As always, please consult your qualified tax consultant.

Join us live every week on the Right Way to HSA at noon PT on LinkedIn, YouTube, or Twitter.

This week we discuss:

- A quick refresher on the tax advantages of HSAs, contributions, and deadlines.

- The tax forms you need for your HSAs.

Can’t watch us live? Watch the replay on LinkedIn, Youtube, or Twitter!