Once you get your employees enrolled and contributing to their health saving accounts, you’ve only won half the battle. A simple fact remains: the majority of employees don’t know that they can invest their HSA dollars. Your employees get stuck accumulating a cash balance in their accounts, and many times unnecessarily spend the money, rather than saving and growing it for the future. While most employees view their 401(k) account as a long-term retirement investing vehicle, they may be overlooking the rewarding investment opportunity of their HSA.

Is An HSA Better Than A 401(K)?

Today, the projected cost of healthcare in retirement continues to rise, with the latest estimates being in the hundreds of thousands of dollars. With numbers that high, employers need to help their employees think about how to fund those medical expenses in retirement. When employees start funding their retirement, they usually look to the 401(k) account as the gold standard of retirement accounts, and view the HSA as a near-term medical spending account. The reality is the HSA has powerful advantages over the 401(k) and should be viewed as a long-term retirement savings vehicle.

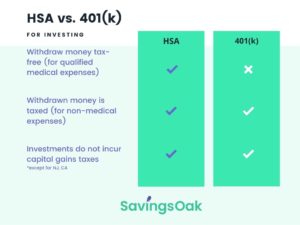

HSA dollars can be withdrawn completely tax-free for qualified medical expenses before 65 and after, which is a feature that doesn’t exist in a 401(k) plan. In both plans, money withdrawn for non-medical expenses after age 65 is taxed according to the account holder’s state and federal tax brackets.

While there are some similarities in their advantages, the HSA is the clear winner as a vehicle for retirement savings. Chances are your employees will need money for healthcare expenses, but even if they need the money for other reasons, they can withdraw it with the same tax consequences as a 401(k) plan.

Get Your Employees Investing From Day One

A modern HSA should make it easy to start investing. SavingsOak further reduces the friction to begin investing with no minimum cash balance to get started. And, we make HSA engagement as easy as 1-2-3 (HSA Engagement is as Easy as 1-2-3 – SavingsOak) with a first of it’s kind HSA Rewards. Your employees receive shares of stock when they enroll in the HSA (1), make pre-tax contributions (2) and begin investing (3). We also help your employees navigate to the appropriate investment line-up, comprised of low-cost ETFs chosen by a professional money manager, by guiding them through an easy and fast risk tolerance assessment. The end result is that your employees get ongoing guidance from an industry-leading money manager so they don’t need to be an investments expert and can spend their time focused on what’s important to them.

SavingsOak partners with you to ensure your employees are prepared for the unexpected healthcare expense today while saving for the ever-increasing cost of healthcare in retirement tomorrow.